What are the licensing requirements for crypto exchanges?

In 2025, launching a crypto exchange without the proper licensing is no longer just risky, it’s nearly impossible. Global regulators, from the European Union to the United States, have adopted more sophisticated frameworks, such as the MiCA Regulation and the GENIUS Act, to enforce compliance, transparency, and consumer protection. Whether you operate a centralized or decentralized exchange, understanding and acquiring the appropriate licenses is now essential to legitimacy, scalability, and legal operation. This article provides a practical guide to global licensing requirements, key jurisdictional updates, and how to secure a license the right way.

Understanding Crypto Exchange Licensing and Its Importance

As the crypto market matures, regulation evolves to protect consumers and align exchanges with global financial standards.

Why do crypto exchanges need a license?

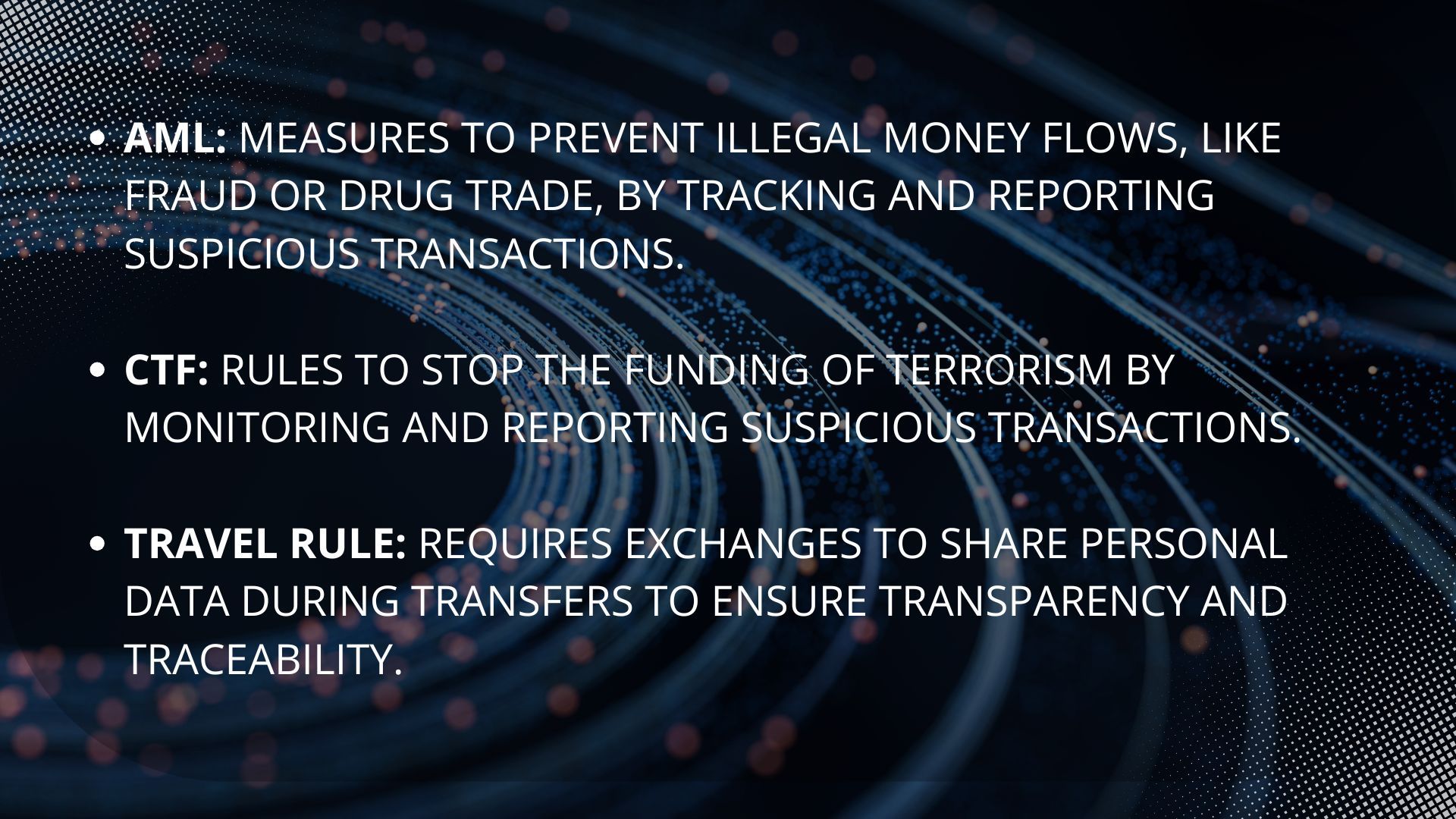

Crypto exchanges are typically classified as Virtual Asset Service Providers (VASPs) under the Financial Action Task Force (FATF) guidelines. This classification triggers mandatory compliance with anti-money laundering (AML), counter-terrorism financing (CTF), and the Travel Rule, which governs how personal data is shared between exchanges.

In the U.S., exchanges must register as Money Services Businesses (MSBs) with FinCEN, while EU-based platforms must obtain authorization under the MiCA (Markets in Crypto-Assets) framework. Licensing enforces strong KYC (Know Your Customer) processes, sanctions screening, and audit trails that align with global norms. Platforms that seek legitimacy and scalability should view licensing not as a burden, but as a strategic asset.

Key risks of operating without proper licensing

Operating without a license can result in asset freezes, criminal charges, or even total platform shutdown.

In the U.S., unlicensed entities can face enforcement actions from both the SEC and CFTC, depending on whether tokens are classified as securities or commodities. Recent ESMA reports show that several European exchanges falsely claimed regulatory approval, prompting major investigations. Ultimately, a lack of licensing erodes user trust, limits partnerships with banks and payment providers, and blocks global expansion.

Major Licensing Requirements for Crypto Exchanges Worldwide

While requirements vary, most jurisdictions expect exchanges to meet key financial and operational criteria.

Financial regulations and compliance standards

To become compliant, exchanges must:

Licenses are typically tied to the type of services offered, spot trading, margin trading, custody, or fiat ramping.

Differences between centralized and decentralized exchange licensing

Centralized exchanges (CEXs) hold custody of user assets, requiring higher regulatory scrutiny around IT systems, cybersecurity, and fund segregation.

Decentralized exchanges (DEXs), while traditionally viewed as protocol-based platforms, may still fall under regulatory oversight, especially if they offer fiat gateways, token issuance, or facilitate automated matching of buyers and sellers. Jurisdictions like the U.K., Singapore, and South Korea have begun expanding VASPs' definitions to include certain DEX operations.

Licensing Requirements in Key Jurisdictions

Here’s how leading jurisdictions have stepped up crypto licensing in 2025:

Crypto exchange regulations in the United States

The U.S. licensing landscape remains fragmented, requiring both federal and state-level compliance.

-New York: Requires the highly detailed BitLicense, a comprehensive regulatory framework for virtual currency businesses, ensuring strict consumer protection and financial transparency.

-Wyoming: Supports blockchain banks under SPDI (Special Purpose Depository Institution) charters, providing a legal structure for digital asset-focused banks.

-Most states require Money Transmitter Licenses (MTLs), which are essential for businesses facilitating the transfer of money or virtual currency.

Platforms looking to operate nationwide often partner with compliance firms to streamline multi-state licensing.

European Union crypto licensing under MiCA

The Markets in Crypto-Assets Regulation (MiCA) became fully enforceable in December 2024, standardizing licensing across all 27 EU member states.

The uniformity helps companies scale faster, but meeting all MiCA criteria takes time and expert legal assistance.

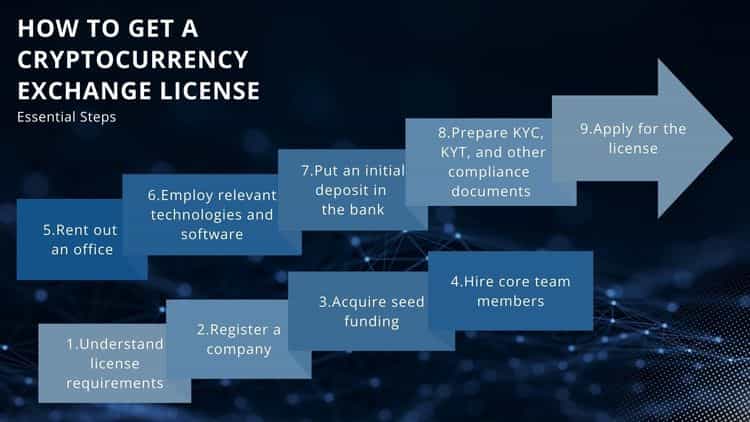

Steps to Obtain a Crypto Exchange License

Here’s a streamlined approach to securing licensing in key jurisdictions:

Required documentation and legal procedures

Common challenges and how to overcome them

Working with regional consultants and reading trusted analysis (like the Rango Learning Center) can ease the journey.

To Sum Up

Crypto exchange licensing in 2025 is no longer a luxury, it’s a gateway to market entry, customer trust, and legal clarity. While global requirements differ, core themes persist: AML/KYC, tech security, and regulatory alignment. With frameworks like MiCA and the GENIUS Act live, platforms that invest in licensing today are those best positioned to scale, innovate, and endure.

“Regulation is the foundation upon which credible, scalable crypto infrastructure is built.” — Michael Saylor

Resources

Frequently asked questions

Check out most commonly asked questions, addressed based on community needs. Can't find what you are looking for?

Contact us, our friendly support helps!

Can a DEX operate legally without licensing in 2025?

In some jurisdictions, yes. But if the DEX facilitates fiat ramps or user data, it may be classified as a VASP and require licensing.

How long does it take to get a crypto exchange license?

On average, 9–18 months, depending on jurisdiction and regulatory readiness.

In web3, what’s the cost of getting licensed?

The cost of getting licensed for a crypto exchange can vary widely, typically ranging from $250K to over $1M. This includes expenses for legal fees, compliance measures, audits, and filing fees, as well as costs for setting up the necessary infrastructure and ongoing operational expenses. The final cost depends on the jurisdiction, the complexity of the business model, and the level of compliance required.