What Are the Legal Implications of Using Crypto for Cross-Border Payments?

Cryptocurrencies are reshaping cross-border payments with faster settlement, lower fees, and programmable transparency, but they also introduce a thicket of legal questions. From AML/KYC duties and licensing to evolving rules under regimes like the EU’s MiCA and U.S. oversight, compliance now defines how and where crypto can move across borders. This article maps today’s regulatory landscape, contrasts permissive and restrictive jurisdictions, and surfaces real compliance risks and penalties. We also examine how banks and payment providers are responding with blockchain rails while navigating volatility and supervision. Finally, we explore why international cooperation is essential to unlock safe, scalable, and compliant global crypto payments.

What are Cross-Border Payments and How Does Crypto Fit In?

Cross-border payments involve transferring funds between individuals, businesses, or institutions in different countries. Traditional systems for these transactions often require intermediaries like banks and clearinghouses, which result in high fees, lengthy processing times, and the potential for errors. The introduction of cryptocurrencies has made cross-border payments faster, more efficient, and cost-effective.

Cryptocurrencies, powered by blockchain technology, provide a decentralized method for transferring value across borders without intermediaries. This makes crypto an appealing option for both consumers and businesses seeking faster and cheaper solutions for international payments. However, the use of crypto for cross-border transactions presents complex legal challenges that must be addressed.

Overview of Global Regulations on Using Crypto for Payments

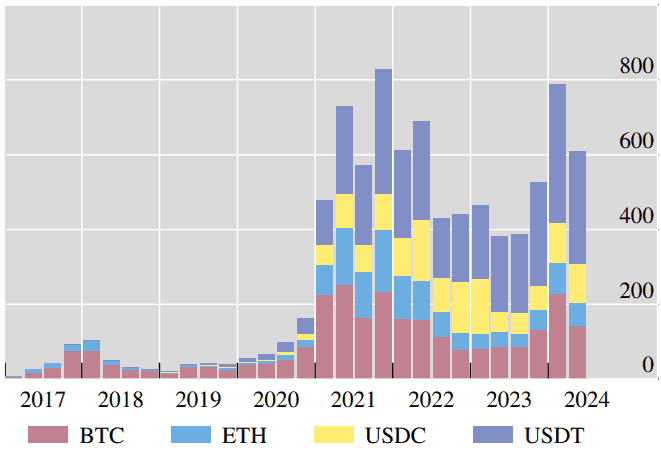

As cryptocurrency adoption continues to grow globally, regulators have stepped in to establish rules governing their use, particularly for cross-border payments. Different countries have taken varied approaches, with some embracing cryptocurrencies, while others impose heavy restrictions.

In regions like Europe, cryptocurrencies are increasingly being integrated into the financial ecosystem, with regulations that ensure clarity for users and businesses. For instance, the European Union's Markets in Crypto-Assets (MiCA) regulation aims to establish uniform standards for crypto transactions across EU member states. Meanwhile, the U.S. is rapidly progressing in its regulatory path, with the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) working towards clear frameworks, contrasting with Europe’s approach of uniformity through MiCA.

Regulatory Trends in Key Jurisdictions

Japan, Switzerland, and Singapore are among the leading countries that have integrated crypto-friendly regulations, offering clear guidelines for crypto transactions. Japan, for example, treats cryptocurrencies as legal property and requires exchanges to follow strict AML and KYC protocols. Switzerland has also adopted a progressive stance, with regulations that support crypto activities while ensuring investor protection. Singapore has positioned itself as a crypto hub, with a regulatory framework that fosters innovation while providing clarity for businesses and users. In contrast, China has implemented a complete ban on crypto mining and restricts the use of cryptocurrencies for payments, highlighting the stark contrast in global regulatory approaches.

The Role of National Regulations in Crypto Payments

National regulations play a critical role in determining how cryptocurrencies can be used for cross-border payments. Since cryptocurrencies operate outside the traditional banking system, governments are concerned about potential risks such as money laundering and terrorism financing. As a result, countries are implementing specific regulations to govern crypto transactions and ensure their safety.

How Different Countries Regulate Crypto Transactions Across Borders

Some countries have adopted laws that closely mirror the regulatory frameworks for traditional finance, requiring crypto platforms to adhere to strict AML and KYC standards. The U.S., for instance, mandates that exchanges and wallet providers comply with the Bank Secrecy Act and register with the Financial Crimes Enforcement Network (FinCEN). Under FinCEN's Travel Rule, transactions involving virtual assets exceeding $3,000 require the collection and transmission of sender and recipient information. This rule applies to both domestic and cross-border transfers, aiming to combat money laundering and terrorist financing.

In contrast, the European Union's Markets in Crypto-Assets Regulation (MiCA) establishes a comprehensive regulatory framework for crypto-assets, including provisions for cross-border transactions. MiCA requires crypto-asset service providers (CASPs) to comply with stringent AML and KYC obligations, irrespective of the transaction amount. Additionally, the EU's Directive on Administrative Cooperation (DAC8) mandates the automatic exchange of information on crypto-assets between member states, enhancing transparency and cooperation in cross-border tax matters.

These regulatory approaches highlight the differing stances on cross-border crypto transactions: the U.S. applies specific thresholds for compliance, while the EU enforces comprehensive, uniform requirements across all transactions.

Legal Challenges and Risks of Using Crypto for International Transactions

While the benefits of using crypto for cross-border payments are clear, several legal challenges still exist. These challenges include compliance with local regulations, the potential for fraud, and the risk of facing penalties for non-compliance.

AML and KYC Compliance Issues

One of the most pressing issues for crypto in cross-border payments is compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. These regulations are designed to prevent illicit activities such as money laundering and terrorist financing. The decentralized nature of cryptocurrencies makes it more challenging for authorities to track and monitor transactions, raising concerns about the misuse of crypto for illegal purposes.

Potential Penalties for Violating Crypto Payment Regulations

Countries have imposed severe penalties for those who violate crypto payment regulations. For example, in the U.S., failure to comply with AML or KYC rules can result in significant fines or even criminal charges. Similarly, the European Union has introduced potential penalties under the MiCA regulation, ranging from fines to more severe consequences for individuals and entities found guilty of illegal activities.

U.S. Enforcement Actions: In the United States, regulatory bodies have taken significant actions against crypto exchanges for non-compliance:

European Union (MiCA) Enforcement Actions: The European Union's Markets in Crypto-Assets Regulation (MiCA) has established a comprehensive framework for regulating crypto assets:

These enforcement actions highlight the significant financial and operational risks associated with non-compliance in both the U.S. and the European Union.

How Cross-Border Crypto Payments Affect Financial Institutions and Banks

The increasing use of cryptocurrencies for cross-border payments has significant implications for financial institutions and banks. These traditional financial systems currently hold a monopoly over international transactions. However, as more people turn to crypto for cross-border transactions, banks may need to adapt to remain relevant.

To maintain control and respond to the rise of decentralized systems, some countries have shifted toward issuing Central Bank Digital Currencies (CBDCs) and stablecoins. Central banks are developing CBDCs to retain control over monetary systems, ensuring they can regulate and oversee transactions. However, CBDCs have faced significant rejection from the public and the broader industry due to their centralization, which contradicts the foundational principles of decentralization that underlie cryptocurrencies like Bitcoin and Ethereum. Despite this, centralization continues to be an obstacle as CBDCs evolve, and there is still a long way to go before they can gain widespread acceptance. The promise of decentralization, where power and control are distributed, not concentrated, is still one of the key attractions of crypto.

Some banks have already started integrating blockchain-based solutions to reduce transaction fees and improve efficiency. However, concerns over volatility, regulatory uncertainty, and security risks have slowed the widespread adoption of crypto in banking systems.

The Potential for Global Cooperation on Crypto Payment Laws

Global cooperation is essential for creating a cohesive regulatory framework for crypto payments. With crypto being decentralized, the absence of global regulations makes it difficult for businesses and individuals to operate across borders seamlessly. International organizations and governments must collaborate to establish common standards that can facilitate secure and efficient cross-border transactions.

Notably, the Genius Act introduced in the United States has emerged as a pioneering regulatory effort aimed at providing clearer guidelines for the use of crypto assets and payments. This framework is being closely followed by the United Kingdom and other jurisdictions, with the goal of creating a globally unified standard for cryptocurrency use in payments. These efforts are essential to ensure that innovation in crypto is embraced while also addressing its risks and potential regulatory challenges.

To Sum Up

The use of cryptocurrencies in cross-border payments offers significant advantages, including faster transaction speeds, lower costs, and increased security. However, navigating the complex legal landscape remains a challenge. It is essential to comply with AML, KYC regulations, and other legal requirements to mitigate risks. Financial institutions and governments need to collaborate and develop a unified regulatory framework to foster a safe, reliable environment for cross-border crypto payments.

Resources

Frequently asked questions

Check out most commonly asked questions, addressed based on community needs. Can't find what you are looking for?

Contact us, our friendly support helps!

What countries allow the use of crypto for cross-border payments?

Countries like Japan, Switzerland, and Singapore have established clear guidelines for using crypto for cross-border payments. On the other hand, countries like China have imposed significant restrictions.

What penalties exist for violating crypto payment regulations?

Penalties vary by jurisdiction, but they often include heavy fines, criminal charges, and, in some cases, asset freezes for failing to comply with regulations such as AML (Anti-Money Laundering) and KYC (Know Your Customer) protocols.

How are banks adapting to the rise of cross-border crypto payments?

Many banks are exploring blockchain-based solutions for cross-border payments, but concerns over security and regulatory uncertainty continue to slow adoption.

When does an asset freeze occur?

An asset freeze is generally imposed in situations where a country or regulatory body has reason to believe that funds are linked to illegal activities or are being used to bypass sanctions. This can be particularly relevant in cross-border crypto transactions, especially in dealing with countries under sanctions. In such cases, decentralized systems like blockchain can help prevent interactions with entities or individuals from sanctioned regions by freezing assets or blocking transactions from these jurisdictions.