Crypto Market Liquidation Crisis: $500 Billion Wiped in October 2025 Crash

The cryptocurrency market faced a catastrophic event in October 2025, with over $500 billion in market capitalization erased in just a few hours. This financial collapse resulted from a combination of geopolitical triggers, leverage, and forced liquidations, which created a massive ripple effect throughout the entire market. In this article, we break down the critical factors that led to the market rout and how different cryptocurrencies, including Bitcoin and Ethereum, were impacted.

What Triggered the $19.5 Billion Biggest Crypto Liquidation?

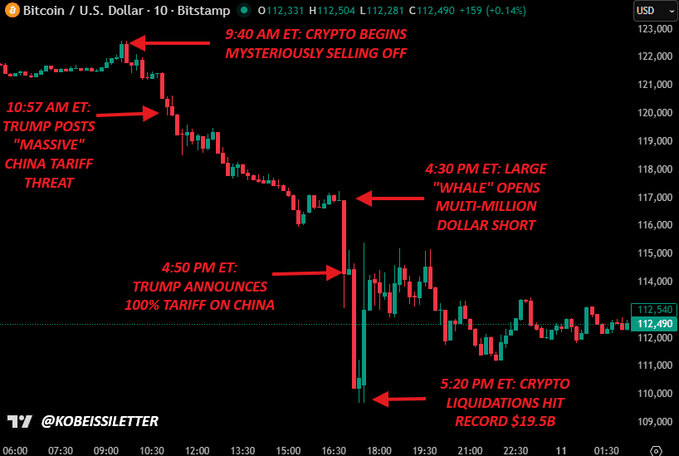

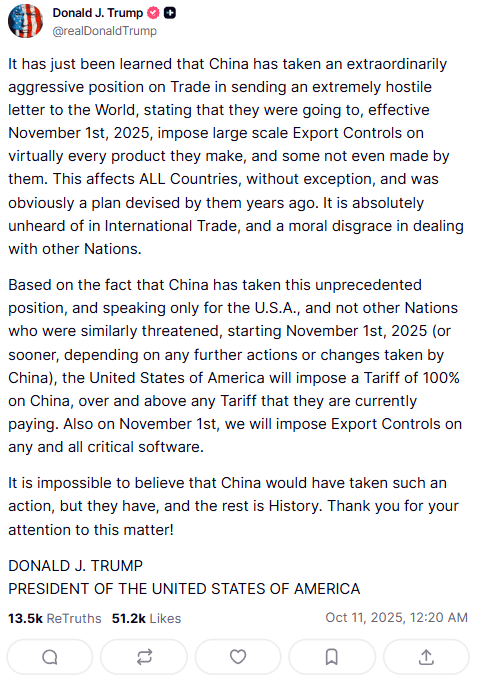

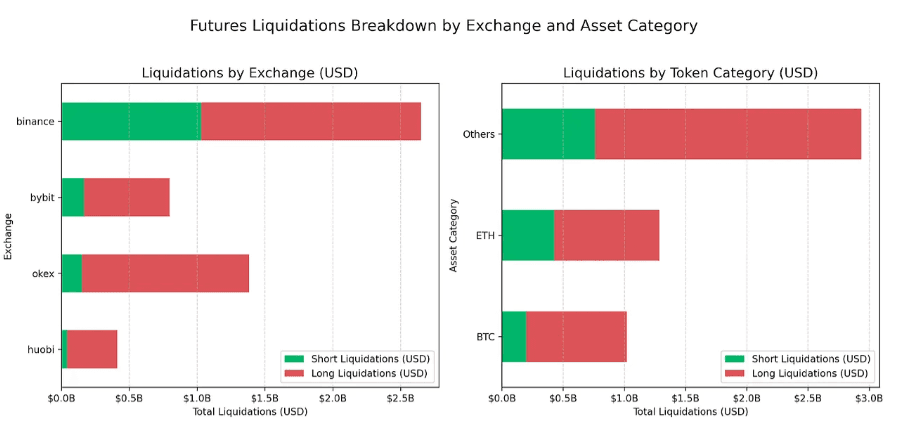

On October 10, 2025, cryptocurrency markets saw their largest liquidation event ever recorded. This event led to the forced closure of leveraged positions, resulting in a staggering $20 billion in liquidations alone. The immediate cause of this was the unexpected announcement by former U.S. President Donald Trump of a 100% tariff on all Chinese imports. This measure rattled global markets and induced panic, especially in speculative markets like crypto.

A Breakdown of the October Crash and Its Massive Impact

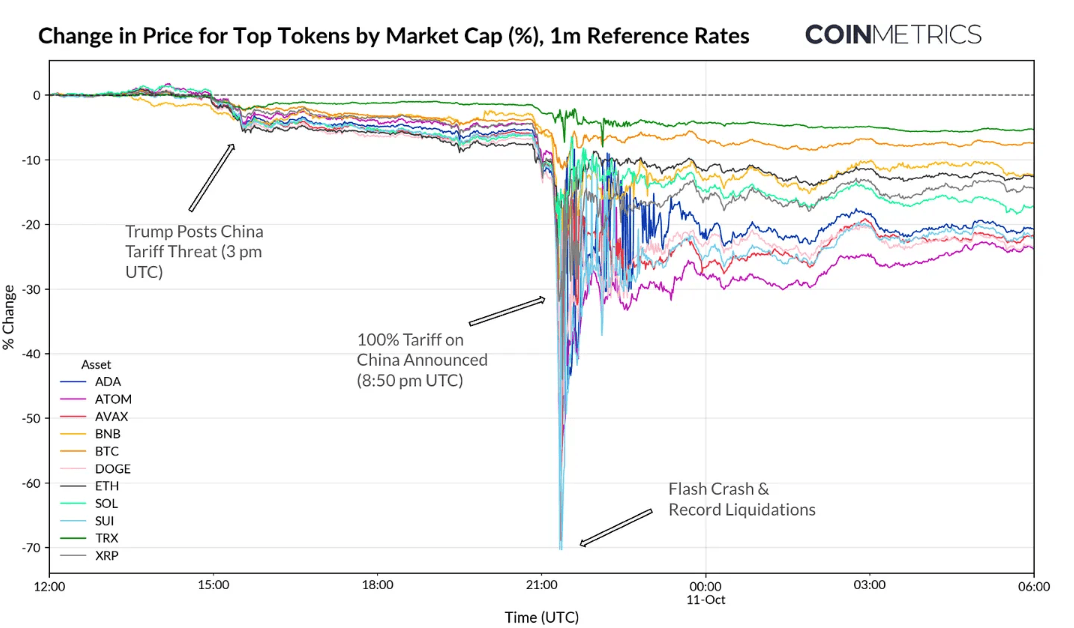

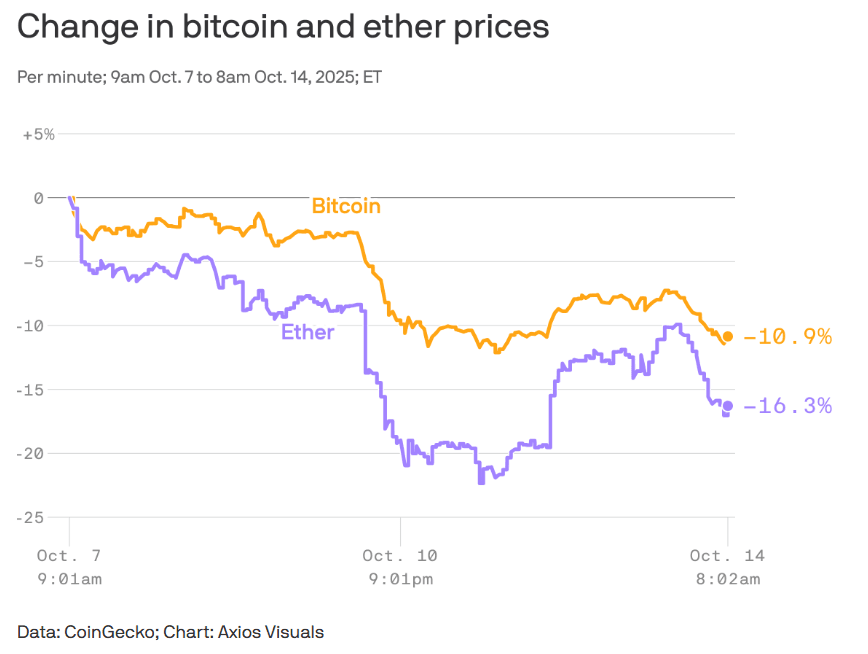

The market reaction to this news was both swift and violent, demonstrating the high volatility of digital assets. Bitcoin, the flagship cryptocurrency, plunged from over $126,000 to below $105,000, reflecting a significant loss. Similarly, Ethereum saw a 12% drop to around $3,436. Altcoins, which are typically more volatile, suffered even steeper losses. For example, HYPE dropped by 54%, DOGE lost 62%, and AVAX plummeted by 70%, showcasing the extreme market conditions and how the liquidation crisis played out across different tokens.

Trump's 100% Tariff Announcement Sparks Market Panic

The announcement by Trump that all Chinese cryptocurrency imports would face a 100% tariff introduced unexpected trade tensions that negatively impacted global risk sentiment. This sudden regulatory action undermined confidence in speculative assets like cryptocurrencies. In reaction to the fear of additional regulatory crackdowns, investors quickly started to liquidate leveraged positions to reduce their exposure, adding to the selling pressure and accelerating the downward spiral in prices.

How Leverage Fueled the October 2025 Crypto Crash

Leverage, the practice of borrowing funds to increase the size of a trading position, played a central role in the October crash. In the world of margin trading, leverage allows traders to take larger positions with a smaller upfront investment. However, this practice increases risk exponentially. As the market started to fall, many traders who had used high leverage to amplify their positions were forced into margin calls and subsequent liquidations, further driving the market down.

Over $19 billion in leveraged positions were liquidated within 24 hours, impacting around 1.6 million traders globally. This forced sell-off exacerbated the price drop, particularly in highly leveraged altcoins, pushing them into steep declines.

The Role of Leverage and Liquidations in Crypto Market Volatility

Leverage has long been a critical factor in the volatility of the crypto market. Because of the high price swings typical in cryptocurrencies, leverage can amplify both gains and losses, resulting in highly erratic price movements.

Why Leveraged Positions Lead to Catastrophic Liquidations?

In leveraged trading, positions are held on margin, meaning the trader borrows funds from an exchange to increase their exposure. When an asset's price falls and the position loses value, exchanges typically require traders to deposit additional collateral to maintain the trade. If the price continues to decline, positions are automatically liquidated, meaning the trader's assets are sold off at market prices, often triggering a cascade of sell orders. This process accelerates the market downturn, as seen in October 2025.

The Role of Forced Liquidations in Market Crashes

Forced liquidations contribute to the rapid price declines seen during crashes. As more traders are forced to liquidate their positions to cover their margin requirements, the increased sell orders cause further downward pressure on prices. This vicious cycle leads to a feedback loop of selling, which can cause sharp declines in asset prices.

Bitcoin and Ethereum: At the Core of the October 2025 Liquidation Wave

As the two largest cryptocurrencies by market capitalization, Bitcoin (BTC) and Ethereum (ETH) were among the hardest-hit assets in the October crash. Despite their size and prominence, both assets experienced significant losses, though they began to show signs of recovery soon after.

Bitcoin's 14% Drop and Recovery

Bitcoin, after reaching $126,000, fell by 14% to below $105,000. This sudden drop was primarily driven by the massive liquidation of leveraged positions and a sudden shift in market sentiment. However, Bitcoin demonstrated resilience, rebounding to around $112,158 in the following days as the market stabilized and traders returned to buy the dip.

Ethereum's Struggles During the Largest Crypto Market Crash

Ethereum experienced a similar downturn, with a 12% drop to around $3,436. Ethereum's decline was more pronounced than Bitcoin's, which can be attributed to its smaller market capitalization and the larger sell-offs that affected altcoins. Ethereum has since managed a partial recovery, trading around $4,096.82.

Altcoins Hit Hard: HYPE (-54%), DOGE (-62%), AVAX (-70%)

The altcoin market suffered the largest percentage losses during the October crash. HYPE, DOGE, and AVAX suffered steep declines, with HYPE falling 54%, DOGE dropping 62%, and AVAX plummeting 70% before staging partial recoveries.

Key Lessons from the $500 Billion Crypto Crash: How to Protect Your Investments

The October 2025 crash serves as a stark reminder of the risks in crypto markets, especially regarding leverage and market sentiment. There are several key takeaways for investors.

The Dangers of Over-Leveraging in Crypto Markets

The widespread use of leverage magnified the losses during the crash. Leveraged positions can lead to catastrophic losses if market prices move against traders. Investors should be cautious about using high levels of leverage and be aware of the risks associated with margin trading.

Practical Strategies to Avoid Liquidation in Future Market Crashes

Will the Crypto Market Recover or Face Further Declines After This Crash?

The future of the crypto market remains uncertain following the October crash. While there have been signs of recovery, significant volatility remains. Various factors, including rising inflation expectations in the U.S. and globally, as well as the ongoing U.S.–China tariff conflict, could continue to shape market sentiment in the coming months.

Expert Predictions on Bitcoin's Price Action Post-Crash

Some analysts predict a strong recovery for Bitcoin, pointing to its established reputation as a store of value. Others, however, warn that the market could face further downward pressure as global financial conditions remain uncertain.

Is the Market Heading for a Rebound or Another Decline?

The market's direction will largely depend on macroeconomic factors such as interest rates, inflation expectations, and the evolving state of the global economy, particularly the impact of the U.S.–China tariff conflict.

While some traders are optimistic about a rebound, others remain cautious, predicting more declines in the coming months.

Resources

Frequently asked questions

Check out most commonly asked questions, addressed based on community needs. Can't find what you are looking for?

Contact us, our friendly support helps!

What caused the October 2025 crypto market crash?

The October 2025 crypto crash was triggered by multiple factors, primarily the sudden announcement of a 100% tariff on Chinese imports by former U.S. President Donald Trump. This policy shock caused panic across global markets and led to a massive $19.5 billion liquidation wave in leveraged crypto positions. Combined with high leverage ratios and cascading forced sell-offs, the event erased more than $500 billion in total crypto market capitalization within hours.

Which cryptocurrencies were hit the hardest during the October 2025 liquidation event?

During the October 2025 liquidation crisis, Bitcoin (BTC) fell about 14%, dropping from $126,000 to below $105,000 before partially recovering. Ethereum (ETH) declined 12%, while major altcoins faced much sharper losses: HYPE (-54%), DOGE (-62%), and AVAX (-70%). These declines highlighted how high leverage and speculative trading amplify losses during extreme market volatility.

Will the crypto market recover after the October 2025 crash?

Analysts remain divided on the market’s future. Some experts expect a short-term rebound as traders “buy the dip” and institutional inflows resume. Others warn of further downside due to macroeconomic uncertainty, including U.S.–China trade tensions, inflation pressures, and tightening liquidity conditions. Historically, Bitcoin and Ethereum have shown resilience after major crashes, but recovery timelines vary depending on global financial sentiment and leverage unwinding.