AI Agents in Crypto: From Trading Bots to Autonomous DeFi Protocols

A shift toward automated decisioning has been observed across crypto markets, where software agents are tasked with monitoring prices, routing orders, and managing on-chain positions without continuous human oversight. This topic matters now because venue fragmentation has increased, latency advantages have narrowed, and composable protocols expose programmable control surfaces that invite automation. It may be tempting to assume that greater autonomy directly yields better outcomes, yet a different behavior has been encountered in practice: the most durable gains are produced when agents are constrained by explicit safeguards and tested against realistic failure modes. As tooling matures, discussion is moving from whether agents should be used to how they should be supervised, updated, and recovered when conditions deviate!

What Are AI Agents in Crypto?

AI agents in this context can be defined as software services that observe market and protocol states, decide on actions, and submit transactions under pre-specified constraints. Early systems operated as scripted bots tied to centralized exchange APIs, where behavior was bounded by rate limits (a cap on requests per time window) and fixed indicators. As decentralized exchanges and lending protocols were integrated, broader action spaces were unlocked: collateral could be rebalanced, orders could be routed through automated market makers, and liquidations could be pre-empted based on health factors. Under these initial conditions, deterministic rules performed adequately until volatility regimes shifted, after which static thresholds required returning.

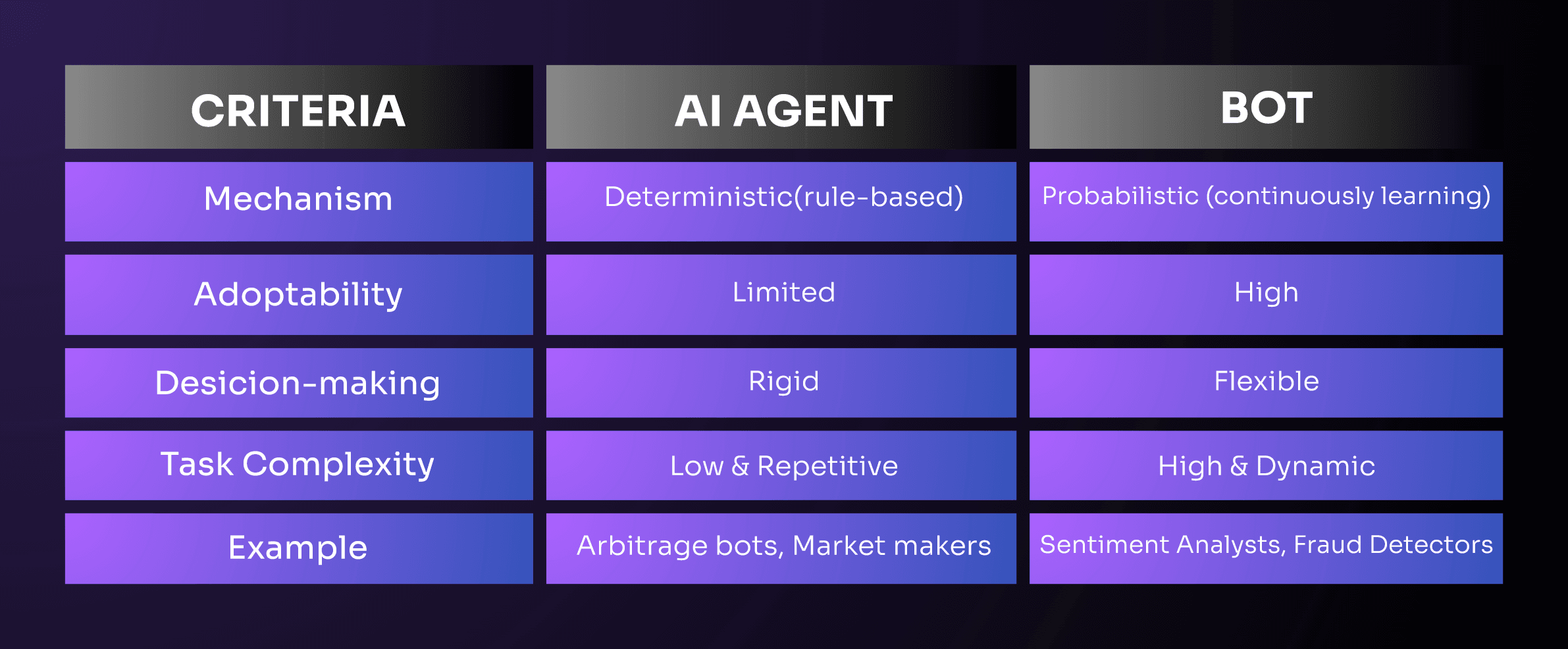

Trading Bots vs. Autonomous DeFi Agents: Key Differences

A useful distinction can be drawn along the dimensions of environment scope and control surface. Traditional bots were observed to operate against single venues or narrow symbol sets, optimizing for latency and fill probability. Autonomous DeFi agents, by contrast, act across many protocols and chains, with composability (the ability to chain operations atomically) serving as the primary advantage. This expansion introduces new failure modes. Strategies that backtested well degraded when gas costs spiked or when adversarial order flow was injected, a pattern likely associated with maximal extractable value (MEV; profit from transaction reordering or sandwiching). Consequently, autonomy is best treated as a capability that must be bounded by safeguards rather than as an unqualified improvement.

How On-Chain Agents Execute Trades and Manage Positions

Modern agents were found to favour event-driven architectures supporting DeFi AI integration and crypto AI technology in which actions are triggered by on-chain signals rather than periodic polling. Account abstraction (programmable accounts that enable batched actions) has been employed to combine approvals, swaps, and transfers into single submissions, improving reliability under typical loads while partially obscuring intermediate steps. Where multi-party computation (MPC; private keys split into independent shares) was used, single-device compromise risk was reduced, though recovery required additional coordination. Parity across desktop and mobile orchestration improved adherence to constraints when thresholds and allow-lists were rendered identically.

Risk Controls for Crypto Agents: MEV, Spoofing, and Oracles

The risk surface was widened once autonomy was granted, particularly as AI in cryptocurrency markets and DeFi automation expanded. Spoofed tokens (fake assets that mimic legitimate tokens to trick automated systems into interacting with them) and malicious routers (fraudulent or compromised smart-contract swap routers that redirect trades to harmful destinations) can be mistaken for legitimate targets unless identifiers are validated. Oracle drift or manipulation can misstate collateral values and induce erroneous deleveraging. Exposure to MEV can inflate slippage and degrade realised prices. Several mitigations were associated with lower incident rates. Contract addresses were sourced from canonical registries rather than interface labels. Private relay submission reduces observable intent and therefore sandwich likelihood, though absolute protection cannot be promised. Parameter updates were rate-limited to prevent rapid oscillations during stress.

Safeguards and Previews: Simulation, Allowlists, and Rate Limiting

Beneficial patterns were recorded around explicit previews and narrow permissions. On-chain simulation (a dry-run estimation of post-trade states) was rendered before confirmation so that failure modes could be surfaced without capital at risk. Allowlists for tokens, routers, and price oracles constrained reachable destinations and reduced spoofing vectors. Rate-limiting was applied to policy updates and order frequency, which prevented feedback loops during congestion. Under constrained bandwidth, batching of status updates and throttled submissions produced a reduction in local queue stalls and time-outs.

Deployment Playbook: From Small Test Trades to Mainnet Budgets

A repeatable deployment habit reduced variance. A micro-scenario is illustrative. A small test transaction was conducted before the primary rollout of an arbitrage agent. With a nominal budget, the agent compared routes across two decentralized exchanges and one lending protocol. A preview was provided by simulating the swap path and liquidation price on a forked environment, after which a live trade of low value was submitted with slippage capped at 30 basis points and a deadline of 45 seconds. Execution logs recorded price impact and gas usage, and a halt condition was triggered when realised spreads narrowed below fees. Capital allocation was increased only after parameters were validated across several blocks.

Performance Factors: Latency, Slippage, and Routing Quality

Comparisons across agents are more reliable when dimensions are named. On latency, co-located off-chain computation with private relay submission was associated with faster inclusion than purely on-chain logic that waits for oracle heart-beats. On slippage, depth-aware routing into concentrated-liquidity pools reduced price impact for mid-sized orders, though gaps were observed during regime shifts. On routing quality, multi-endpoint RPC designs with health-checks degraded more gracefully than single-endpoint configurations. Causality was not established for every relationship, but correlations were consistent across typical loads and device classes.

Operational Habits That Reduce Error Rates

Several procedural habits were found to sustain reliability. Back-ups were created and verified using encrypted configuration exports and MPC recovery ceremonies, with periodic drills that excluded production secrets. Identifiers were confirmed against official registries before any new market was activated. Canary budgets and time-boxed observation windows were used for policy changes, and anomalies, such as divergence between predicted and realised slippage, triggered automatic deferrals. During fee spikes, conservative slippage thresholds and shorter deadlines limited toxic fills, and actions were postponed until conditions stabilised when discrepancies could not be reconciled.

Institutional Readiness: Auditability, Custody Boundaries, and Reporting

Institutional adoption has been correlated with clear custody boundaries and reconstructable audit trails. Whitelisted pools and permissioned deployments were tested to satisfy policy constraints while preserving deterministic pricing. Reporting requirements were met when trade logs, oracle updates, and fee schedules were exported on a fixed cadence. In moderate sizes, execution quality compared favourably on the dimension of price impact, while residual concerns remained around venue fragmentation and cross-chain settlement risk. These concerns can be mitigated but cannot be eliminated, and therefore must be factored into risk budgets.

X402: A New Player in the Agentic Web

In parallel to the broader evolution of AI-driven crypto ecosystems, the organisation X402 has emerged as a noteworthy participant in the space. X402 focuses on integrating machine-learning agents into protocol-level operations, offering an autonomous layer that can monitor on-chain health metrics, rebalance positions, and route liquidity across chains under pre-defined policy constraints. By providing both a developer SDK and an institutional dashboard, X402 aims to bridge the gap between traditional trading algorithms in crypto and full-fledged autonomous DeFi protocols. Their architecture emphasises transparency, every trade path is logged, simulations are mandatory before execution, and system behaviour halts automatically when threshold conditions are breached. In doing so, X402 exemplifies how AI in cryptocurrency markets can be shaped not just for speed and scale, but for controlled, auditable deployment.

Future Outlook: Guarded RL and Policy-Bound Autonomy

Innovation appears to be moving toward safer autonomy rather than unconstrained exploration. Guarded reinforcement learning, where policies propose actions but on-chain checks enforce invariants, has been introduced to combine adaptability with safety. Programmatic risk budgets are being expressed as parameters that agents cannot exceed, and governance modules restrict upgrades to staged, reviewable releases. As data quality improves through normalized event streams and richer simulation frameworks, training-target drift is expected to shrink, although adversarial tactics cannot be ruled out and will continue to require replication under live conditions.

Summery

Stepping back, a broader pattern is visible: durable performance has been achieved not by removing humans but by relocating human judgement to the design of constraints, previews, and recovery. Autonomy has been most productive where agents are asked to execute narrow tasks well and to fail closed when uncertainty rises. Two compact heuristics may be useful in practice. First, small, reversible tests should be favoured before large, irreversible actions; a tiny trade or rebalance should be executed with conservative slippage and short deadlines to validate routing and gas assumptions. Second, recoverability should be rehearsed; backups should be created and verified using documented procedures, while kill-switches and rate limits ensure that actions are deferred and retried after transient anomalies are detected. Guarantees cannot be given, but error rates can be reduced when identifiers are verified, previews are read closely, and autonomy is bounded by explicit rules.

Resources

Frequently asked questions

Check out most commonly asked questions, addressed based on community needs. Can't find what you are looking for?

Contact us, our friendly support helps!

How are AI agents in crypto different from traditional trading bots?

AI agents operate across the entire DeFi ecosystem, not just a single exchange. Traditional crypto trading bots follow fixed rules and execute basic buy/sell logic.

Modern AI agents:

Because they interact directly with smart contracts, they require safeguards like allowlists, slippage limits, and previewed transactions. The biggest difference is scope + autonomy, which offers more capability but demands tighter risk controls.

What risks do autonomous DeFi agents face, and how are they mitigated?

Autonomous agents face threats unique to blockchain environments, including:

Safe agents always simulate the trade path before execution. If a preview shows abnormal outcomes, the agent should revert automatically.

What should institutions look for when adopting AI-powered crypto platforms?

Institutions need auditability, predictability, and control, not just automation. Key features include:

Platforms like X402 model this approach by enforcing previews, logging every route, and halting when thresholds are breached.