Unichain Technical Review

Ethereum’s Layer 2 ecosystem has rapidly expanded, producing networks that reduce costs, increase speed, and broaden accessibility while inheriting Ethereum’s robust security model. Among these L2s, Unichain, developed by Uniswap Labs, stands out as a purpose-built chain designed to optimize decentralized finance. Unlike many generalized L2s that target broad ecosystems, Unichain’s core mission is to become the home for liquidity and financial applications, focusing on speed, fairness, and interoperability. In this review, we present a comprehensive exploration of Unichain’s technical design, use cases, operations, integrations, ecosystem performance, and outlook, and we highlight how it differentiates itself in the increasingly competitive rollup landscape.

TL;DR

This article explores Unichain’s features, growth metrics, and challenges, with a particular focus on its role in the DeFi space, especially with Uniswap v4. It combines security, speed, and a strong ecosystem to emerge as a leading L2 solution. Below is a brief overview, followed by a detailed list of key aspects that highlight its performance and positioning, ensuring users searching for related topics can easily find and explore these points:

Technical Architecture

Unichain’s architecture is a layered composition of Ethereum settlement, OP Stack rollup logic, an EVM-equivalent execution environment, and a TEE enforced block builder that introduces microsecond scale ordering guarantees. This section traces the full data path from a user transaction to L1 finality, details the derivation pipeline and fault proofs, explains gas accounting and fees, and clarifies how Flashblocks change the execution and MEV landscape.

Rollup Foundation on the OP Stack

At its core Unichain is an Optimistic Rollup that publishes data and state commitments to Ethereum. The OP Stack contributes three classes of components.

-

L1 contracts that manage deposits and withdrawals, define system parameters, and host the fault proof game.

-

L2 execution and state transition implemented by a Geth based client that is modified for EVM equivalence under rollup constraints.

-

The derivation pipeline that reconstructs L2 blocks from L1 posted data and validates the L2 state root against L1 outputs.

Posting data to Ethereum provides data availability. The rollup assumes L2 state transitions are valid unless challenged during a fixed dispute period. Any honest actor can submit a challenge, which aligns security with Ethereum because the dispute resolution runs on L1.

EVM Equivalence and Execution Semantics

Unichain targets bytecode level EVM equivalence. Contracts that compile and run on Ethereum mainnet run identically on Unichain. Precompile addresses, gas schedules, opcode semantics, and environmental invariants match Ethereum within OP Stack constraints. Tooling such as Hardhat, Foundry, and standard ABI wallets work without modification. The execution client is an op-geth derivative that preserves Ethereum’s state transition rules and plugs into the rollup specific fee and block metadata.

Sequencing, Batching, and the Derivation Pipeline

From the perspective of a node there are three heads.

-

The unsafe head is the tip produced by the live sequencer that users see immediately.

-

The safe head is the portion of the chain whose data has been included on L1, hence it can be deterministically reconstructed from L1.

-

The finalized head is the portion that is beyond the fault proof window on L1 and can no longer be disputed.

The sequencer orders user transactions into L2 blocks and emits batches to L1 through a batcher. Batches are usually compressed frames that ride in calldata or blob space which reduces cost post EIP-4844. The derivation pipeline inside op-node rehydrates these frames, checks integrity, and deterministically rebuilds the exact L2 block stream. This is the mechanism that turns L1 as a data and settlement layer into an authoritative source of the L2 canonical chain.

The sequencer provides liveness by publishing a continuous stream of L2 blocks. Safety derives from the fact that any safe head block is fully reconstructible from L1 data. Finality derives from the fault proof window. Clients typically display the unsafe head to users for immediacy, mark the safe head for deterministic reconstruction, and present the finalized head for strong confidence. Applications that require economic certainty can wait for a policy defined number of L1 confirmations after the challenge window, which is a common practice for bridges and institutional dApps.

Fault Proofs and the Dispute Game

To finalize L2 state on L1, the rollup submits periodic output proposals that commit to an L2 state root at a specific L2 block height. Each proposal enters a challenge window.

If challenged, L1 runs an interactive bisection game to isolate a single step of the disputed state transition. A fault proof virtual machine then checks that single step with L1 verifiable execution.

If the challenger is correct the proposal is rejected and the prover can be penalized. If no one challenges during the window, the proposal is considered confirmed. The important property is permissionless proving and permissionless challenging. Anyone with the correct software and sufficient funds for gas can enforce validity, which removes trust in the sequencer beyond the bounded challenge period.

Deposits, Withdrawals, and Messages

Deposits originate on L1 in the portal contract. A deposit message is enqueued, then materialized on L2 as a system transaction at the next available block. Withdrawals originate on L2, get included into the L2 withdrawal root, and later can be proven on L1 after the dispute window for the corresponding output proposal has elapsed.

Cross domain messaging between L1 and L2 follows the same path. Messages are either deposits from L1 to L2 or withdrawals from L2 to L1. Within the OP Stack family, L2 to L2 messaging is being standardized so that a message can be relayed across sibling rollups without an intermediate user step. Unichain is designed to participate in that model, which is relevant for intent based cross chain swaps and Rango’s aggregator logic.

Gas Accounting and Fee Markets

A Unichain transaction pays two components.

-

The L2 execution fee that covers computation and storage on the L2 EVM and is priced with an EIP 1559 style mechanism.

-

The L1 data fee that pays for the bytes posted to Ethereum, either as calldata or as a blob.

Total fee equals L2 execution gas used multiplied by L2 gas price plus L1 data gas equivalent multiplied by L1 data gas price. Post EIP 4844, batches can move to blobs which are cheaper per byte than calldata, which materially reduces the second term. On top of the base fee, a user can include a priority fee, which is the economic signal that the TEE builder uses to determine ordering.

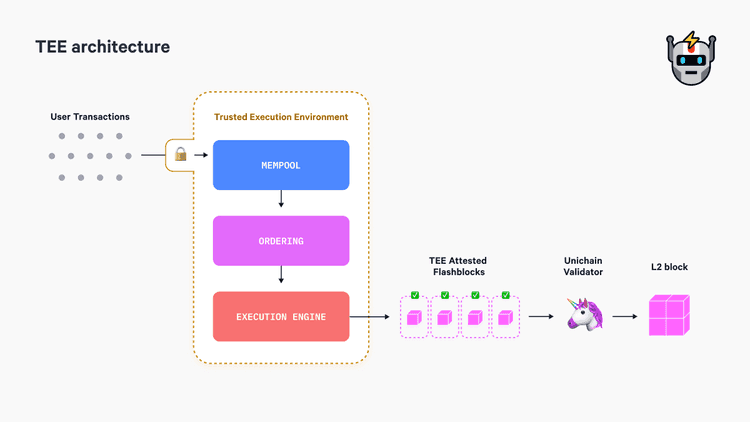

Flashblocks and TEE Enforced Ordering

Unichain’s builder runs inside a Trusted Execution Environment such as Intel SGX or AMD SEV SNP. The builder receives a feed of pending transactions and produces micro blocks at 200 millisecond cadence inside the one second block. The ordering rule is strict priority by effective fee. A remote attestation proves that the correct binary with the correct configuration produced the block and that the rule was enforced.

Two practical consequences follow. Executions become near instant for users, which reduces adverse selection against LPs in AMMs and tightens spreads for market makers. Sequencer side MEV such as arbitrary reordering or insertion is constrained by the attested rule. The builder also implements revert protection. Transactions that deterministically fail under the current state are filtered before inclusion, which suppresses wasteful gas burn and improves UX.

Roadmap to Validator Attestation

oday the single sequencer establishes ordering and publishes to L1. The roadmap introduces a community validation layer where nodes stake UNI on Ethereum and attest to the validity of each L2 block. Attestations can be aggregated with BLS or a similar scheme and used by applications as a fast finality signal that is economically backed by UNI stake. This does not replace the fault proof window on Ethereum. It creates a tiered trust model, with fast economic finality provided by staked validators and ultimate settlement and dispute resolution provided by Ethereum.

Use Cases

Unichain’s design and ecosystem integrations create strong foundations for diverse applications. Its focus on low-latency, fairness, and liquidity concentration makes it particularly suited for financial protocols.

Decentralized Finance

Unichain’s primary domain is DeFi.

Cross-Chain Liquidity

As part of the Optimism Superchain, Unichain is designed for seamless L2-to-L2 communication. Beyond this, integrations with LayerZero, Wormhole, Synapse, Across, Hyperlane, and Polymer extend connectivity to dozens of other chains. This makes Unichain a hub for cross-chain swaps and omnichain yield strategies.

High-Frequency Trading

With 200ms confirmations and transparent fee-priority ordering, Unichain enables real-time DeFi strategies. LPs benefit from tighter arbitrage loops and higher realized fees, while market makers can provide liquidity with reduced slippage risk. This design also paves the way for on-chain RFQ systems, order book-style exchanges, and derivatives platforms that rely on low-latency execution.

NFTs and Gaming

Although DeFi-focused, Unichain has begun to attract NFT and gaming projects. Crypto: The Game (CTG) launched on Unichain, demonstrating its ability to handle high-throughput social gaming interactions. OpenSea integrated Unichain for NFT trading, validating its readiness for broader Web3 use cases.

Institutional DeFi

With Fireblocks custody integration, institutional funds and market makers can securely access Unichain’s liquidity. This positions the chain not only as a retail trading hub but also as a venue for professional capital allocation and trading strategies.

Operational Model and Tokenomics

The operational model of Unichain combines Optimistic Rollup mechanics, sequencer-driven execution, and a future validator staking network.

Ecosystem and Integrations

The strength of Unichain’s ecosystem is its deep integration with existing infrastructure and protocols.

Metrics and Performance

| Metric | Value (2025) | Notes |

|---|---|---|

| TVL | ~$25M at launch → ~$1.3B peak (July) | Currently stabilizing around $700M–$900M |

| Bridge TVL | ~$788M | Value in Ethereum bridge contracts |

| Stablecoins | $344M circulating (June 2025) | ~52% native USDC issuance |

| Transactions | 500k–1M daily, peaks up to 46 TPS | Average ~8–10 TPS |

| Users | 500k DAU, 6M MAU within 3 months | Millions of unique addresses created |

| DEX Volume | $600M+ daily peaks | ~2.2% of all-chain DEX volume, majority Uniswap v4 |

| Fees | <$0.01 per swap | Revert protection avoids wasted gas on failed txs |

Challenges and Outlook

While Unichain’s trajectory is impressive, several challenges remain.

Despite these challenges, Unichain is already a top-tier Ethereum L2 by TVL, volume, and user count. Its focus on DeFi, alignment with Uniswap, and novel MEV protections give it a strong competitive edge.

Conclusion

Unichain represents a critical step forward in Ethereum scaling. By combining Ethereum-level security, sub-second block confirmations, provable transaction fairness, and UNI-driven decentralization, it has quickly established itself as a central liquidity hub in DeFi.

For Rango Exchange, Unichain’s depth of liquidity, integration with cross-chain protocols, and efficiency gains in execution make it an essential ecosystem to integrate and monitor. As Unichain matures with validator staking and deeper Superchain interoperability, it has the potential to define what a financial Layer 2 should be.

Resources

-Unichain TEE Architecture – Body Image

Frequently asked questions

Check out most commonly asked questions, addressed based on community needs. Can't find what you are looking for?

Contact us, our friendly support helps!

How do I bridge assets to Unichain from Ethereum or other L2s?

Easily bridge assets using Rango Exchange, a cross-chain aggregator that finds the best route, optimizing fees and minimizing slippage for seamless transfers between Unichain, Ethereum, and various other blockchains and Layer 2s, including Bitcoin, Solana, and more.

What are Flashblocks and how do they affect trading?

Flashblocks are sub-block confirmations (~200ms) produced inside a TEE that enforce priority-by-fee ordering, giving near-instant pre-confirmed and reducing reorder MEV, useful for LPs and market makers.

How do I add Unichain to MetaMask and deploy contracts?

Add the Unichain RPC and chain ID in MetaMask (EVM-equivalent). Use your existing Ethereum toolchain (Hardhat/Foundry) and point it to Unichain’s RPC to deploy.