What Makes the Best Dex Aggregator? Key Features Explained

The decentralized finance (DeFi) ecosystem has experienced massive growth over recent years, and at the heart of this evolution lies the Decentralized Exchange (Dex) Aggregator. These platforms aggregate liquidity from various DEXs, offering traders the best possible prices and minimizing slippage. In this article, we’ll dive into what makes the best Dex aggregator, exploring its core features, performance metrics, and why it’s indispensable in today’s DeFi landscape.

What is a Dex Aggregator and Why is it Important?

A Dex Aggregator is a platform that connects multiple decentralized exchanges, pooling their liquidity to provide better trading opportunities. In a space where transactions occur on blockchain networks, liquidity aggregation is essential for achieving optimal price execution. For traders, using a Dex aggregator means being able to find the best possible prices and liquidity, thereby reducing slippage and trading fees. The importance of these aggregators in the DeFi space cannot be overstated as they significantly improve the efficiency of decentralized trading.

How Dex Aggregators Enhance Trading Efficiency in DeFi?

Dex aggregators help streamline the trading process within decentralized finance by offering several advantages. These platforms aggregate liquidity across various blockchain networks and DEXs, ensuring that the trader always gets the best price available without having to search each exchange manually.

Price Discovery Across Multiple Exchanges

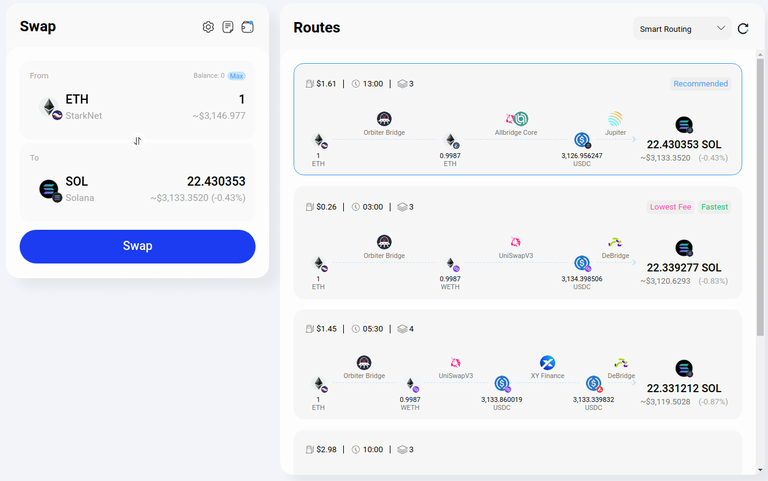

One of the key ways Dex aggregators enhance efficiency is through real-time price discovery. As decentralized exchanges are often fragmented, a trader might not be able to find the most favourable price on a single platform. By connecting various exchanges, a Dex aggregator automatically identifies the best rate, optimizing the trading experience for users.

Access to a Larger Pool of Liquidity

Without a Dex aggregator, traders might find themselves dealing with insufficient liquidity on certain exchanges. This can cause issues such as higher slippage, especially when executing large trades. Dex aggregators overcome this by consolidating liquidity, which is crucial for both retail and institutional traders.

Key Features That Define the Best Dex Aggregators

The best DEX aggregators stand out not only for connecting liquidity across multiple DEXs but also for addressing common DEX aggregator use cases such as token swaps, cross-chain transfers, and portfolio rebalancing. These features improve overall trading efficiency and make top platforms excel.

Multi-Chain Compatibility and Liquidity Optimization

The multi-chain compatibility of a Dex aggregator is one of its most important features. As blockchain technology evolves, multiple networks (such as Ethereum, Binance Smart Chain, Solana, and others) are increasingly gaining traction. The best Dex aggregators provide users with access to liquidity across multiple chains, offering seamless interoperability between them.

By aggregating liquidity from various blockchain networks, these platforms ensure optimal price execution and the reduction of trading costs.

User-friendly interfaces and Real-Time Price Comparisons

For traders, the user experience is critical. A good Dex aggregator should have an intuitive interface that allows for easy navigation, whether you're a seasoned trader or a beginner. This includes features like real-time price comparisons, which help users identify the best rates instantly.

Most of the best Dex aggregators offer interactive charts and advanced filters, allowing users to analyze prices and execution speeds before committing to a trade. This enhances the overall experience and improves decision-making.

Evaluating Performance Metrics for Dex Aggregators

When selecting a Dex aggregator, evaluating its performance metrics is essential to ensure that the platform can meet the needs of traders. Below are some key metrics that define the performance of a Dex aggregator.

Transaction Speed and Gas Fee Reduction Capabilities

Transaction speed is a critical factor, especially when it comes to DeFi trading. The faster a transaction is processed, the less likely a trader is to experience price slippage or delays. Moreover, gas fees can be an expensive aspect of decentralized trading. The best DEX aggregators optimize routing to reduce these costs, and platforms like Rango, with its protocol 0-fee, give traders an edge by making swaps both faster and more cost-effective.

Security Measures and Risk Management Features

With increasing cyber threats, security is paramount when using any DeFi platform. Dex aggregators are built with strong security features such as smart contract audits, multi-signature wallets, and risk management protocols that help protect user assets. Having these robust security measures in place ensures that traders can operate in a secure and trustworthy environment.

The Future of Dex Aggregators in Decentralized Finance

Dex aggregators are pivotal in the growth of decentralized finance. However, they are continually evolving as new technologies and user needs emerge. Here are some trends that could shape the future of these platforms.

Innovative Trends Shaping the Next Generation of Dex Aggregators

As blockchain technology continues to innovate, so too will the capabilities of Dex aggregators. Future trends include AI-driven trade optimization, which could further improve price prediction and reduce slippage. Additionally, cross-chain interoperability will be a significant focus as more blockchain ecosystems emerge, requiring a seamless way to access liquidity from various networks.

Potential Impact of Dex Aggregators on Global DeFi Adoption

Dex aggregators are likely to play a crucial role in mainstream DeFi adoption. By providing users with easy access to multiple DEXs, they democratize access to liquidity, making decentralized finance more accessible to the masses. With the increasing adoption of cryptocurrencies and decentralized solutions, Dex aggregators will become an essential part of the global financial infrastructure.

Conclusion

In conclusion, the best Dex aggregators combine multiple key features such as multi-chain compatibility, liquidity optimization, user-friendly interfaces, and robust security measures.

As DeFi grows, these platforms will remain essential for efficient and secure trading. Among them, Rango Exchange stands out with its broad cross-chain coverage, smart routing, and transparent interface, making it one of the top choices for traders.

Resources

Frequently asked questions

Check out most commonly asked questions, addressed based on community needs. Can't find what you are looking for?

Contact us, our friendly support helps!

How do Dex aggregators reduce slippage?

Dex aggregators minimize slippage by routing trades through exchanges that provide the best available prices and liquidity. By pooling liquidity from multiple sources, they ensure better price execution even for large trades.

Can I use a Dex aggregator on multiple blockchains?

Yes, the best Dex aggregators are multi-chain platforms, which means they provide liquidity from different blockchain networks, such as Bitcoin, Ethereum, Solana and others.

Are Dex aggregators secure for trading?

Yes, Dex aggregators prioritize security by implementing features such as smart contract audits, multi-signature wallets, and risk management protocols. These measures ensure that user funds are protected against potential threats and vulnerabilities in the decentralized space.