Are Automated Market Makers Crypto-Friendly? Addressing the Myths

Automated Market Makers (AMMs) have quietly reshaped how crypto trading and liquidity provision happen. Instead of matching buyers and sellers, trades occur directly against algorithmically managed pools, creating a continuous flow of liquidity, but not without quirks. Observing these patterns reveals practical trade-offs in slippage, fees, and risk management that traders and liquidity providers need to understand. Read the full breakdown below for a detailed, operational perspective on AMMs in crypto.

Understanding AMMs and their role in crypto

Automated Market Makers (AMMs) have become a core component of decentralized finance (DeFi). Unlike traditional order-book exchanges, AMMs rely on algorithmic pricing, allowing users to trade digital assets directly against liquidity pools. The adoption of AMMs has grown alongside decentralized exchanges (DEXs), largely because they remove the need for a central counterparty and maintain continuous liquidity for a wide range of tokens.

How AMMs work in Decentralized Finance

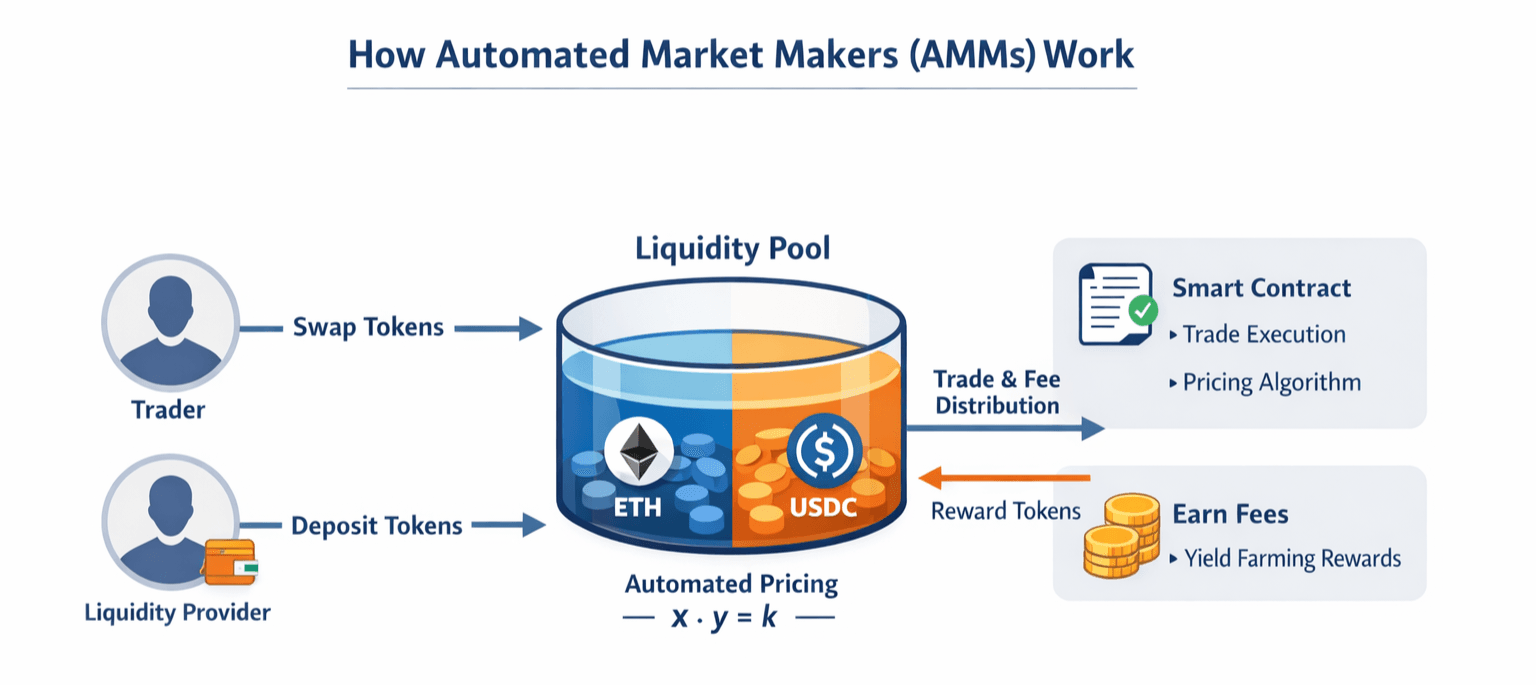

Automated Market Makers (AMMs) power trading in decentralized finance by using liquidity pools, pools where users deposit pairs of assets, like ETH and USDC, to enable trades. Instead of relying on traditional order books, AMMs determine prices algorithmically, often using formulas such as the constant product formula x⋅y=k.

Liquidity providers earn a portion of the trading fees based on their share of the pool. A simple example illustrates how this works in practice: when testing a trade of 0.5 ETH against a USDC pool, you’ll notice that slippage, the difference between expected and actual price, grows with trade size. This is why many traders break up large orders into smaller pieces to reduce their impact on the market. In short, while AMMs make liquidity more accessible, they don’t completely eliminate price sensitivity to trade size.

Debunking the myths about Automated Market Makers

AMMs are sometimes portrayed as fully decentralized and immune to manipulation. The reality is more nuanced.

Are AMMs truly decentralized and trustless?

The interface presented to the user is generally trustless, as trades execute through smart contracts. However, the initial liquidity, governance parameters, and smart contract audits still require careful scrutiny. Some pools are subject to permissioned upgrades or central administrative controls, which may introduce subtle points of centralization. Observationally, traders often check deployment history and audit reports before providing liquidity, highlighting operational awareness as essential.

Do AMMs eliminate market manipulation and front-running?

AMMs reduce but do not eliminate manipulation risks. Sandwich attacks and front-running can occur due to predictable pricing formulas and public mempool visibility. Monitoring transaction previews, using smaller trades, and interacting with pools of sufficient liquidity mitigate, but do not eradicate, these risks. Practical usage shows that high-volume pools with diverse liquidity tend to be more resistant to front-running than low-liquidity alternatives.

Benefits of AMMs for crypto traders and liquidity providers

Automated Market Makers offer advantages for both traders and liquidity providers by streamlining decentralized trading and creating new earning opportunities. For traders, AMMs provide instant access to liquidity without the need for traditional order books, making it easier to swap tokens, even less popular ones, though trade size can affect slippage. For liquidity providers, depositing assets into AMM pools opens the door to passive income from transaction fees, with the potential for additional rewards through yield farming. While returns can vary depending on trading activity and impermanent loss, AMMs make it possible to participate in decentralized markets efficiently and profitably, even on a small scale with test deposits.

How AMMs improve liquidity and reduce trading friction?

AMMs provide constant liquidity without relying on order matching. Traders experience near-instant swaps, though slippage varies with pool size and trade magnitude. The operational implication is that AMMs enable seamless token access, especially for niche tokens not supported on major exchanges.

Earning passive income through liquidity pools and yield farming

Liquidity providers earn a portion of transaction fees, effectively creating passive income. Yield farming amplifies this effect by distributing protocol tokens as additional rewards. Observationally, returns fluctuate based on trading volume and impermanent loss. Small-scale test deposits are commonly used to gauge performance before committing larger amounts.

Typical Returns and Risks for AMM Liquidity Providers:

| Pool Type | Avg. Fees Earned | Observed Impermanent Loss | Notes on Risk Management |

|---|---|---|---|

| ETH/USDC | 0.2–0.3% | Low–Moderate | Large pool size reduces slippage exposure |

| Small-cap tokens | 0.5–1% | High | High volatility increases impermanent loss |

| Multi-token pools | 0.3–0.6% | Moderate | Complexity may affect withdrawal efficiency |

Challenges and risks of using Automated Market Makers

While AMMs offer many benefits, they also come with practical challenges and risks that users must navigate. One common issue is slippage, where the execution price deviates from the expected price, especially for large trades or smaller pools. Impermanent loss is another concern for liquidity providers, occurring when asset prices shift and reduce potential gains. Some token pairs suffer from low liquidity, making swaps more expensive or less efficient. Traders often mitigate these risks by splitting large transactions into smaller trades and carefully monitoring pool ratios. Additionally, high gas fees on busy blockchains can make smaller trades uneconomical, emphasizing the importance of strategic transaction sizing and thoughtful risk management when interacting with AMMs.

Security risks and smart contract vulnerabilities in AMMs

While AMMs offer seamless decentralized trading, they are not immune to security risks. Because they rely on smart contracts, even small bugs in code, flawed AMM logic, or untested pool features can lead to significant financial losses. Flash-loan attacks and other exploits have shown how quickly vulnerabilities can be exploited. To mitigate these risks, users should review audit reports, check the protocol’s historical track record, and start with small trial transactions before committing larger amounts. Seasoned participants also follow essential precautions: verifying contract addresses carefully, using secure wallets, and maintaining backups. By combining vigilance with cautious engagement, traders and liquidity providers can enjoy the benefits of AMMs while minimizing exposure to security pitfalls.

Sum up

AMMs are a technically elegant solution to liquidity provision and decentralized trading, but they are not universally frictionless or risk-free. Observed patterns indicate that operational vigilance, small test trades, audit verification, monitoring slippage, and pool size awareness, is key to effective engagement. Two practical heuristics emerge: trade incrementally to manage price impact, and validate smart contract sources before committing liquidity.

Resources

Frequently asked questions

Check out most commonly asked questions, addressed based on community needs. Can't find what you are looking for?

Contact us, our friendly support helps!

What Are AMMs and How Do They Work?

Automated Market Makers (AMMs) are protocols that allow crypto assets to be traded directly through liquidity pools, rather than relying on traditional order books. Prices are determined algorithmically based on the ratio of tokens in the pool, using formulas like the constant product (x.y = k). Trades execute instantly against the pool, and liquidity providers earn fees for each swap proportional to their share. AMMs power decentralized exchanges like Uniswap and Balancer, enabling continuous trading and access to tokens that might not be available on centralized exchanges.

What Risks Should You Know Before Using AMMs?

Despite their advantages, AMMs carry several risks. Slippage can occur when large trades shift pool ratios, resulting in worse-than-expected prices. Impermanent loss affects liquidity providers when token prices diverge, potentially reducing earnings compared to holding tokens outside the pool. AMMs also rely on smart contracts, which may contain bugs or vulnerabilities, and front-running attacks can manipulate transaction ordering. Risk mitigation includes starting with small trades, verifying contract audits, choosing pools with sufficient liquidity, and monitoring gas fees, all of which help reduce exposure while still benefiting from AMM trading and liquidity provision.

How Do Traders and Liquidity Providers Benefit from AMMs?

AMMs provide constant liquidity, allowing traders to swap tokens instantly without waiting for matching orders. This is especially useful for niche or less popular tokens. Liquidity providers earn passive income from transaction fees, and many protocols offer additional rewards through yield farming or governance tokens. While returns vary depending on trading volume and price fluctuations, AMMs make it possible for both small and large participants to engage in decentralized markets efficiently, often with minimal technical setup.