Analyzing the Popularity of Cross-Chain Transactions in DeFi

DeFi is on the brink of transforming finance, but its fragmented landscape threatens to keep this revolution in silos, until cross-chain technology steps in to unify it all. However, as blockchain ecosystems multiply, each with their unique standards and token formats, DeFi faces its biggest bottleneck: fragmentation. Value, liquidity, and innovation are locked within isolated chains, creating a disjointed user experience. Enter cross-chain transactions, the mechanism by which assets and data are transferred between disparate blockchain networks, creating a truly unified financial system. This article delves deep into why cross-chain functionality has become indispensable, the key drivers accelerating its adoption, the risks and technical constraints involved, and how emerging innovations are shaping the next phase of DeFi.

Why Cross-Chain Functionality Is Vital to DeFi?

To realize DeFi's vision of a decentralized, inclusive, and efficient global financial system, interoperability across networks must become the norm, not the exception. Cross-chain capabilities allow protocols to transcend their native environments and foster a more composable and interconnected DeFi landscape.

Unlocking Interoperability Across Networks

Cross-chain interoperability refers to the seamless ability of different blockchain ecosystems to communicate, share data, and execute transactions across disparate networks.

As the blockchain landscape diversifies with the proliferation of Layer 1s like Ethereum, Solana, and Avalanche, and Layer 2 solutions such as Arbitrum and Optimism, the user experience is becoming fragmented, often requiring multiple wallets and interfaces.

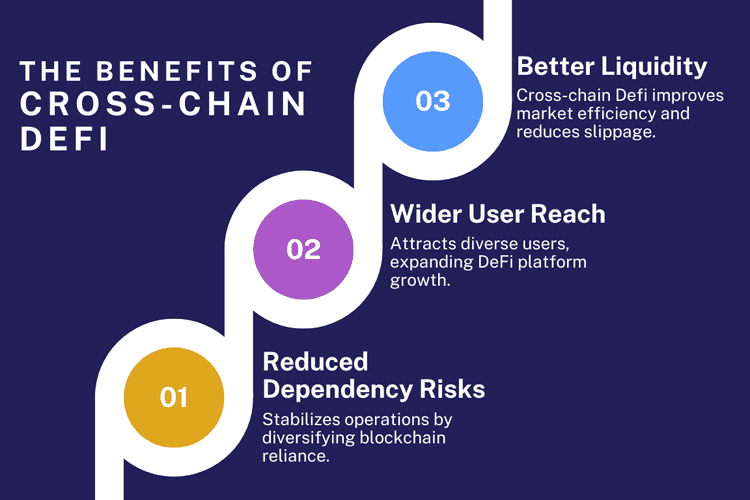

Cross-chain solutions bridge this divide, offering several critical benefits:

Cross-chain technology is crucial in realizing a future where blockchain networks operate as interconnected, cooperative systems, rather than isolated silos.

What Drives the Rise of Cross-Chain Transactions?

Cross-chain transactions are rising due to evolving user behavior, increasing demand for diversified opportunities, and technological advancements that eliminate long-standing friction points.

Growing User Demand for Interconnected Finance

Modern DeFi users manage diverse portfolios spread across multiple chains, and they expect frictionless asset mobility and interaction. Cross-chain aggregators such as Rango Exchange have made it possible to swap tokens across more than 70 blockchains with one-click convenience. This demand is driven by:

Cross-chain aggregators gather liquidity from multiple AMMs and liquidity pools, offering users access to a wider range of assets and better trading conditions.

These platforms analyze and simulate multiple routes for token swaps, ensuring the best possible price and minimal slippage for the user.

By choosing the most efficient routes, aggregators minimize gas fees and network charges, reducing overall transaction costs.

Rango DEXs and bridges aggregator offers zero fees for its users, providing a transparent, cost-effective trading experience without unexpected costs.

Users now expect seamless interoperability between blockchains, making cross-chain functionality a critical factor for competitiveness and usability in DeFi platforms.

Advantages Over Traditional Single-Chain Models

Conventional DeFi ecosystems confine users within chain-specific barriers. In contrast, cross-chain transactions enable:

Cross-chain transactions allow users to move their assets across different blockchains, ensuring their funds are always deployed where they can earn the highest yield, rather than being confined to one network.

By spreading assets across multiple chains, users can reduce the impact of a failure or downturn in any one chain, minimizing systemic risk and improving portfolio stability.

Access to liquidity across chains opens up opportunities for dynamic arbitrage, where users can take advantage of price discrepancies between different networks, enabling more complex trading strategies.

Cross-chain routing improves transaction efficiency by selecting the best paths for trades, reducing both time delays and transaction costs compared to single-chain models.

Challenges Slowing Cross-Chain Progress in DeFi

Despite the momentum, cross-chain functionality faces significant challenges that must be addressed before it can be universally trusted and adopted.

Security and Smart Contract Limitations

Security is the most pressing concern. Cross-chain bridges have been prime targets for exploits, including the infamous Ronin, Wormhole, and Harmony hacks. Chainalysis reports over $2 billion in losses from cross-chain bridge attacks in 2022 and 2023. Key risks include:

Until these risks are mitigated via formal verification, multi-party computation (MPC), and improved decentralization, trust in cross-chain protocols will remain a barrier.

UX, Costs, and Standardization Barriers

User experience remains inconsistent. Many bridges and aggregators offer clunky interfaces, unpredictable gas fees, and manual configurations. Common issues include:

This fragmentation highlights the need for standardized messaging protocols like LayerZero and IBC to ensure interoperability. Platforms like Rango Exchange are tackling these challenges by providing exhaustive technical documentation, which streamlines user navigation through bridging and cross-chain interactions, ultimately enhancing transparency, reducing complexity, and optimizing efficiency.

The Future of Cross-Chain Transactions in DeFi

Despite current limitations, innovations in security, infrastructure, and abstraction are rapidly transforming cross-chain technology into a scalable, reliable standard.

Advanced Technologies Improving UX and Trust

Next-generation solutions are paving the way toward a seamless, decentralized experience:

As noted in Consensys and other whitepapers, these technologies aim to replace or supplement legacy bridges with trust-minimized alternatives.

Driving Scalable, Inclusive DeFi Adoption

Cross-chain innovations are no longer fringe experiments, they're driving real adoption across diverse sectors:

Yield optimizers are now scanning liquidity pools across various blockchains, maximizing returns by accessing the best opportunities in different ecosystems.

Decentralized Autonomous Organizations (DAOs) are deploying treasury assets across multi-chain vaults, enhancing asset management and increasing the potential for cross-chain governance.

Gaming platforms and NFT ecosystems are adopting cross-chain metadata, enabling interoperability and creating more immersive, cross-platform user experiences.

By enabling scalable, inclusive, and composable finance, cross-chain tools will unlock broader DeFi adoption.

Conclusion

Cross-chain transactions are essential for unlocking the full value proposition of DeFi. By breaking down barriers between isolated chains, they facilitate capital efficiency, improved access, and protocol composability. Yet, scalability and adoption depend on overcoming security vulnerabilities and UX limitations. Through aggregators like Rango Exchange and technologies like ZKPs and MPC, the path forward is becoming clearer.

"Interoperability is the next frontier, blockchains that don’t talk can’t win."

— Vitalik Buterin, Ethereum Co-founder

The future of DeFi will not belong to a single chain, but to the web of secure, scalable, and interconnected protocols that make true decentralization a global reality.

Resources

Frequently asked questions

Check out most commonly asked questions, addressed based on community needs. Can't find what you are looking for?

Contact us, our friendly support helps!

How do cross-chain bridges work in DeFi?

One type of bridges lock assets on one chain and issue equivalent tokens on another, allowing cross-chain asset movement without centralized exchanges.

What makes cross-chain transactions safer today?

Modern bridges use ZKPs and MPC tech to reduce vulnerabilities, improving security and decentralization.

Can I earn more with cross-chain DeFi?

Yes. Cross-chain tools help you access better yields across blockchains, reduce fees, and discover new farming opportunities.