How on-chain price impacts NFT valuation?

On-chain data turns NFT valuation from guesswork into measurement. Every bid, sale, and transfer is recorded on a public ledger, enabling price indices, liquidity ratios, and risk screens that weren’t possible in traditional art markets. In practice, on-chain price signals liquidity depth and confidence, while revealing manipulation and demand cycles. Academic and market research now shows price, volume, and liquidity form the core triangle of NFT value formation. To know more about blockchain’s role in pricing and its transparent benefits, read the article below!

What is on-chain price in the context of NFTs?

In the context of NFTs, on-chain price refers to the actual transaction prices that are permanently recorded on a blockchain through smart contracts. These are the realized prices, meaning they come from successful trades, bids, or sales that have been executed and confirmed on-chain (for example, when an NFT is sold on OpenSea or swapped via an automated market maker pool).

Unlike off-chain listings or quotes, which are just asking prices, on-chain prices reflect final, verified sales. Each transaction includes details such as the sale amount, timestamp, and wallet addresses involved. Because this data is immutable and publicly accessible, it provides a transparent, auditable record of NFT market activity, the kind used by analytics platforms like NFTGo, CoinGecko, and academic researchers to build time-series charts and valuation indices.

Example: When a Beeple work sells via an NFT marketplace and settles on Ethereum, that sale price, fee, and counterparty hash become the canonical data for future floor-price and volume metrics. Major reports build indices from these settlement events to compare collections over time.

The relationship between on-chain price and NFT value

For most collections, value is anchored by recent clearing prices (last sale), current floor listings, and liquidity at/near the floor. Liquidity and volume are consistently identified as key predictors of NFT prices, whereas pure social buzz can overstate value. Liquidity depth is therefore a key risk lens.

Empirical studies have found that sustained trade volume and tighter bid-ask ranges are correlated with more resilient prices, whereas thin order books tend to magnify volatility and exacerbate herding effects. As a result, valuation models often weight volume, number of unique buyers, and time-to-sale alongside rarity scores.

How on-chain price affects the liquidity of NFTs

Liquidity is both input and output, prices attract liquidity, and liquidity stabilizes prices. On-chain execution reveals this feedback loop in real time.

Liquidity and its importance in determining NFT prices

Liquidity refers to how easily NFTs within a collection can be bought or sold without causing large price swings. Collections with high trading volume and many active buyers and sellers near the floor price tend to have smoother price movements, their listings get sold quickly and prices stay close to the collection’s true or rarity-adjusted value.

In contrast, collections with low liquidity or sparse order books often experience higher slippage, meaning sellers must offer steep discounts to attract buyers. Studies show that trading volume and market participation are among the strongest drivers of NFT price changes, behaving similarly to microcap stocks in traditional finance, where thin liquidity amplifies volatility.

How on-chain price data influences NFT market trends

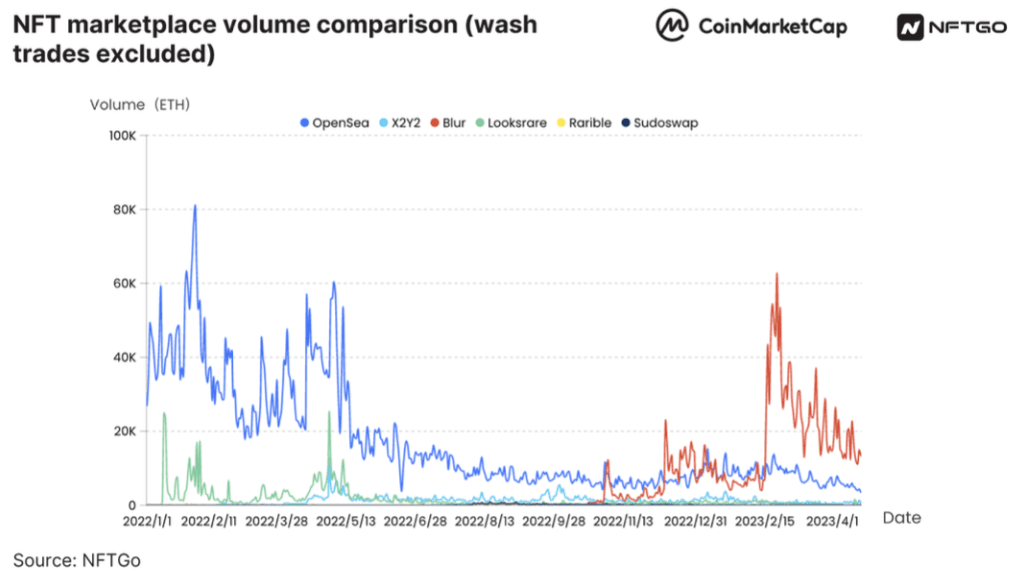

During 2023, the influx of marketplace incentives (for example bidding seasons, points-rewards, zero-fee trades) drove large spikes in NFT volumes and floor prices. These short, incentive-driven surges were often followed by mean reversion once the rewards faded. In other words, the on-chain transaction data didn’t just reflect passive demand, it actively shaped headline market trends. Analytics and market-wide reports captured this pattern: a sharp rise in Q1 and a subsequent cooling period as traders shifted strategies and incentives dropped.

Factors contributing to on-chain price fluctuations

On-chain price is sensitive to micro (collection) and macro (crypto) forces, plus marketplace rules.

Together, these forces drive the volatility and trend shifts seen in on-chain NFT data.

Demand and supply dynamics in NFT marketplaces

NFT prices are driven by shifting demand and supply within marketplaces. Key indicators include the number of active wallets, unique buyers, and the density of listings (how many NFTs are for sale near the floor). On the supply side, creator actions, such as new mints, burn events, or airdrops, can expand or contract available supply, directly influencing price levels.

Analytical indices built from executed on-chain sales show that buyer retention and collection concentration heavily shape price trends. When a small number of “superstar” collections (like BAYC or Pudgy Penguins) attract most trading activity, liquidity and attention drain from smaller projects, amplifying volatility and widening price gaps across segments.

External factors affecting on-chain price and NFT valuation

Beyond marketplace activity, external crypto market forces also play a major role in NFT valuation. Broader crypto beta, the movements of assets like ETH and SOL, affects buying power and sentiment across all NFT collections.

In addition, policy shifts such as changes in royalty enforcement can alter how much value flows to creators versus traders, reshaping price dynamics. Periods of abnormal trading, like wash trading or artificial volume spikes, can distort on-chain data, creating misleading price signals.

That’s why researchers and analytics platforms often apply filters and statistical models (as seen in peer-reviewed studies on abnormal-trade detection) to identify genuine market trends and remove noise from valuation datasets.

The role of blockchain technology in NFT price tracking

Blockchains offer transparent provenance and immutable execution logs, enabling price verification and index construction.

Blockchain's transparency and price verification

Because every NFT transaction is recorded on a public blockchain, analysts can verify sale authenticity directly from the ledger, including buyer, seller, timestamp, and sale price. This transparency allows anyone to reconstruct trade histories, detect suspicious activity, and ensure that reported prices match real, executed transactions. Institutions such as the UK Parliament’s Digital Assets Inquiry and analytics firms like Chainalysis often cite this traceability as the feature that enhances market integrity and reduces dependence on unverifiable, off-chain broker data.

Real-time tracking of NFT value through on-chain data

NFT blockchains update state data nearly in real time, meaning each sale or bid instantly adjusts the visible market metrics. Dashboards such as NFTGo, CoinGecko, and DappRadar aggregate these on-chain events to deliver up-to-the-minute figures for floor prices, volumes, and market velocity. This continuous flow of on-chain data lets analysts and traders track market shifts as they happen, producing the monthly and annual chartbooks that summarize collection performance and broader sector trends.

Predicting NFT value based on on-chain price data

Forecasting models blend realized prices with liquidity, wallet diversity, and rarity factors.

Analyzing historical price data for better valuation predictions

Researchers and analysts use historical NFT transaction data to identify pricing patterns and build predictive valuation models. Academic studies have proposed NFT-specific indices and factor models that capture drivers such as liquidity, trading volume, and “superstar” artist effects, where a small set of creators dominate market attention.

In practical analysis, backtesting techniques are often applied: rolling windows of floor prices, trade counts, and average “time-to-clear” (how long listings stay active before selling) can signal regime shifts, such as accumulation versus distribution phases. These metrics help forecast when markets may be heating up or cooling down.

Tools and platforms that help assess on-chain price for NFTs

Professional NFT analysts typically combine multiple data sources and tools to refine valuation accuracy:

For a broader investment context, analysts often integrate macro crypto reports (ETH/SOL beta correlations) to align NFT valuations with wider market cycles.

When managing treasuries or executing token legs around NFT transactions, routing trades efficiently across DEXs and bridges helps minimize slippage. Rango Exchange, for example, optimizes this process by aggregating liquidity from multiple decentralized sources, ensuring more efficient execution and better pricing for NFT-related token swaps.

Conclusion

On-chain price isn’t just a number; it’s a live diagnostic of liquidity, demand concentration, and market structure. The strongest evidence across research and market summaries is that volume and liquidity conditions lead observed prices, while social signals and incentives can create transient dislocations.

Practical valuation stacks therefore:

(1) anchor to realized on-chain sales and floor depth

(2) adjust for abnormal trading and incentive distortions

(3) incorporate rarity/collection fundamentals.

In short, on-chain transparency makes it possible to price what you can prove, and to detect when the price you see is not the whole story.

Resources

Frequently asked questions

Check out most commonly asked questions, addressed based on community needs. Can't find what you are looking for?

Contact us, our friendly support helps!

What’s the difference between floor price and last sale price?

Floor is the lowest current listing; last sale is the most recent executed price. Floors move with supply; the last sale proves what cleared. Use both, plus volumes and time-to-sale, for valuation.

How do I spot wash trading in a collection?

Red flags include circular wallet flows, extreme same-wallet turnover, and prices far from peer collections; anomaly-detection research provides feature sets to screen these patterns.

Do crypto market swings matter for NFTs?

Yes, crypto market swings affect NFTs. Changes in ETH or SOL prices influence NFTs priced in these assets and even those priced in USD, as their value is linked to underlying cryptocurrencies.